Our previous blog post reviewed the basics of understanding the HOA balance sheet, an integral component of HOA financial statements. Today, we will cover another essential financial document – the income statement. This statement provides valuable insights into an HOA's revenues, expenses, and overall financial performance, making it a must-understand tool for HOA board members and residents.

- The income statement's dynamic nature differs from a balance sheet by providing a performance overview for a specific period, which aids in identifying trends and making decisions.

- The significance of net income analysis, as the difference between total revenue and expenses, lies in assessing financial health. Consistent positive or negative net income shows effective management or financial instability.

- Regular (ideally quarterly) reviews of the income statement are necessary to monitor financials, detect issues early, and ensure stable, sound decision-making.

Basics of the HOA Income Statement

The income statement, often referred to as the profit and loss (P&L) statement or statement of income and expenses, is a comprehensive report of an association's earnings and expenditures over a given period. Unlike the balance sheet, which offers a snapshot of financial health at a given moment, the income statement demonstrates how well an HOA has managed its income and expenses over time. The dynamic quality makes the income statement invaluable for showing trends and comparisons to make smart financial decisions.

Understanding the Components of the HOA Income Statement

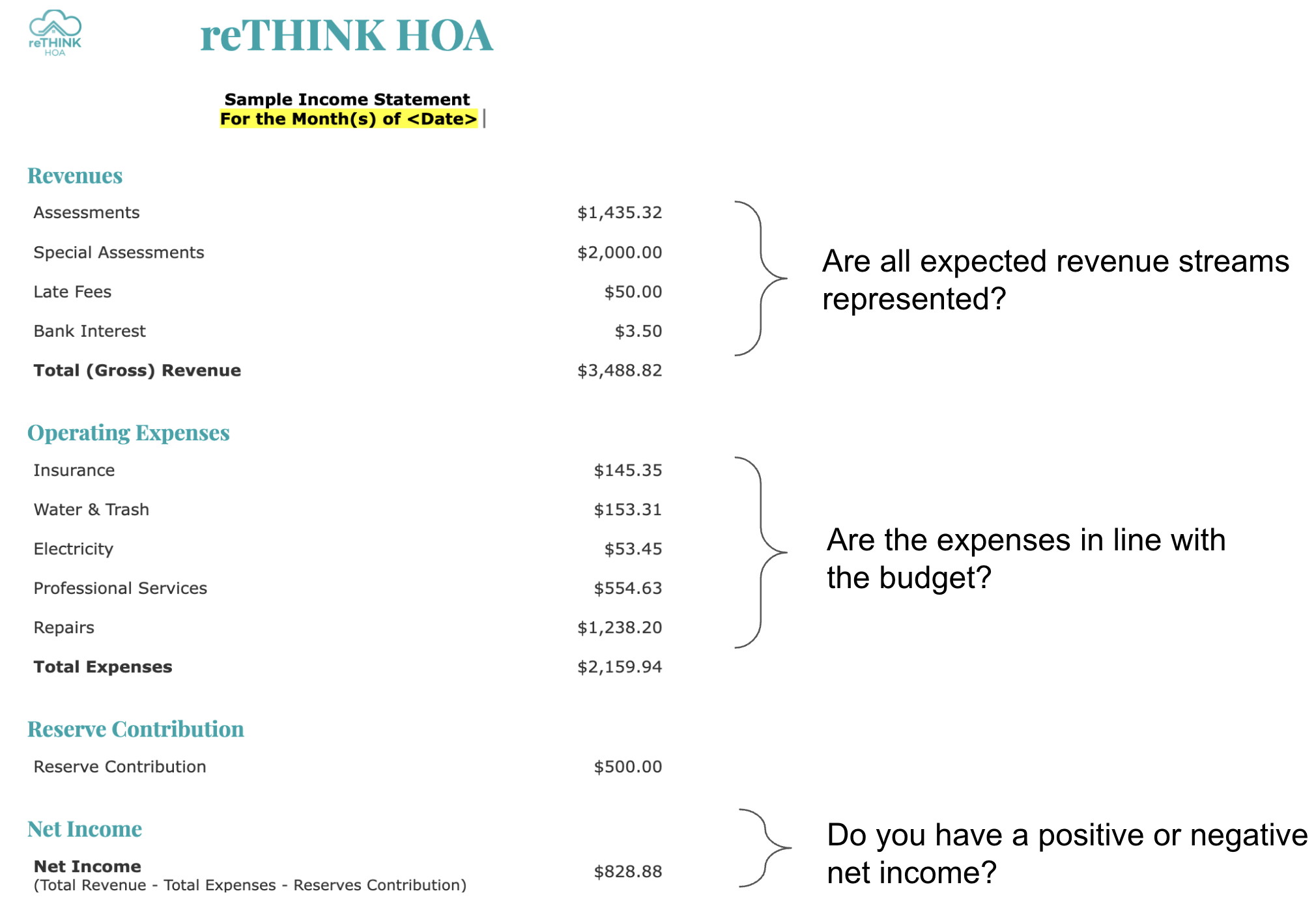

The HOA income statement breaks down into three primary sections: total revenue, operating expenses, and the resulting net income. Let's explore these items in more depth.

Total Revenue / Gross Revenue

Operating Expenses

Understanding these individual components will help you interpret the association's income statement and overall financial health.

Interpreting the HOA Income Statement

Understanding how to read and interpret the income statement is as crucial as understanding its components. It involves analyzing whether your association is operating at a loss or profit.

Gross Profit

Gross profit is calculated as the total revenue minus the cost of goods sold (COGS). HOAs typically do not have COGS in their income statements because they primarily provide services, not goods. So for the most part, HOAs' gross profit is the same as the total revenue, which includes any dues, fees, and charges collected.

Net Income

Net income is the difference between gross profit and expenses. The entire report culminates with the calculations of this value. Analyzing net income provides insight into the HOA's profitability.

How to Review Your HOA's Income Statement

Reviewing the income statement of your HOA is essential for maintaining financial stability and ensuring sound decision-making. Here are the top things to check when you review your HOA's income statement:

- Revenues: Are all expected revenue streams represented? Ensure that all expected revenue streams are represented, such as member dues, special assessment income, and other income. If any expected revenue is missing, or if there is an unexpected decrease, it could be a sign of an issue that needs to be addressed.

- Expenses: Are the expenses in line with the budget? Look at each line item of expenses and compare them with the budgeted amounts. Any expense that is significantly higher than expected could indicate a problem, like overspending or unexpected costs. Similarly, lower-than-expected expenses could point to neglected maintenance or services.

- Net Income: Do you have a positive or negative net income? A positive net income suggests that the HOA generates more than it spends, indicating good financial health. Consistent negative net income might be a warning sign of financial instability and may necessitate further investigation and action.

- Trends: Compare against previous periods. Do you notice any trends, shifts, or potential issues when analyzing the current income statement in the context of the HOA's financial history? Reviewing a single income statement in isolation might not provide a complete picture. Instead, compare the current income statement with previous periods to identify trends, shifts, and potential issues.

Reviewing your HOA's income statement should not be a once-a-year task. Given the dynamic nature of the income statement, regular reviews—preferably quarterly—can help you keep a close eye on the association's financial health.

Final Thoughts

Understanding the HOA income statement is crucial to good HOA management. While it might seem intimidating at first glance, a thorough understanding of its components and regular reviews can demystify this document. In combination with the balance sheet and other financial statements, the income statement can provide a holistic picture of your association's financial health.

Continuing to educate yourself on financial matters can only strengthen your HOA. Stay tuned for our upcoming posts on the remaining HOA financial statements to deepen your understanding further.

Subscribe to stay updated, learn more, and equip yourself to make better decisions for your community.