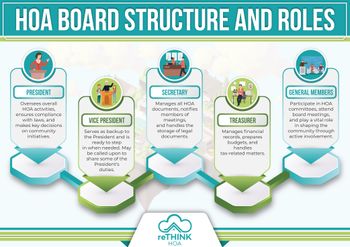

Continuing our series on key HOA board positions, we've previously detailed the influential roles of the HOA President in The HOA President's Guide: Roles, Responsibilities & Best Practices and the Secretary in The HOA Secretary's Guide: Roles, Responsibilities & Best Practices. Now, we focus on another fundamental role that ensures the financial health of any successful homeowners association (HOA): the Treasurer. Just as the President steers the leadership course and the Secretary manages detailed records, the Treasurer stands as the financial steward of the community.

An HOA Treasurer does more than balance the books. The Treasurer acts as the community's financial guardian, overseeing the HOA's financial health and sustainability. With responsibilities spanning budget planning, financial reporting, investment management, and ensuring compliance with relevant laws and regulations, the Treasurer's role is central to the financial well-being of the entire community.

The Treasurer's ability to effectively manage finances impacts the HOA's short-term operations and shapes the long-term financial strategy. The fiscal decisions made by the Treasurer directly affect every resident, influencing everything from property values, assessments, and the quality of community services and amenities.

This guide is a resource for current and aspiring HOA Treasurers. It is designed to outline the key roles, responsibilities, and best practices associated with this vital position. Whether you are newly elected or an experienced Treasurer looking to enhance your effectiveness, this guide will provide valuable insights and actionable strategies.

- The Treasurer oversees all HOA's financial aspects, from budgeting and accounting to financial reporting. The role involves ensuring transparency, maintaining accountability, collaborating closely with other board members, and educating the community on financial matters.

- The Treasurer is pivotal in building community trust through transparent and accurate financial reporting.

- Specialized software tools are available to assist the Treasurer in financial management, compliance, and communication, making the role more efficient and effective.

The Role of an HOA Treasurer

The role of the HOA Treasurer is primarily financial. A responsible Treasurer is essential to a financially sound community with transparent, ethical financial management. The financial stability of any homeowners association lies in its budgeting, financial reporting, and diligent oversight of funds. As the Treasurer, your role is central to these financial functions, ensuring that they are conducted with precision, accountability, and in accordance with legal regulations. The success of the community often hinges on well-managed finances.

Crafting and adhering to a budget that aligns with the community's needs and expectations requires a comprehensive understanding of financial principles. It's about managing the funds, making informed financial decisions, and providing transparent reporting without compromising the community's financial integrity. Modern financial software and tools can enhance this financial stewardship, allowing you to manage the community's funds efficiently without becoming overwhelmed by complex financial tasks.

Post-budgeting, the accurate and timely reporting of financial transactions and status becomes essential. Leveraging accurate record-keeping and transparent reporting ensures trust and clarity among homeowners. Organizing and presenting these financial records user-friendly ensures comprehension, compliance, and a robust financial foundation for the association's initiatives and obligations.

The role of the Treasurer in the homeowners association is multifaceted and requires a blend of financial acumen, organizational skills, and ethical commitment. By leveraging the right tools and best practices, the HOA Treasurer can elevate their management of the community's finances, transforming them from number-crunching tasks to strategic functions that bolster community financial health and governance.

Overview of Treasurer's Responsibilities

The HOA Treasurer's main responsibilities are organized into four key areas:

- Fiscal Responsibility and Oversight

- Managing Financial Records and Accounts: Ensuring accurate and timely record-keeping, including managing bank accounts and financial statements.

- Budget Planning, Monitoring, and Review: Developing and overseeing the HOA's budget, tracking expenses, and making necessary adjustments.

- Handling Assessments and Delinquencies: Implementing procedures for collecting dues and managing delinquencies.

- Investing and Managing Reserves: Safeguarding and growing the HOA's reserve funds through prudent investment and management.

- Financial Reporting and Transparency: Preparing and presenting regular financial reports to the board and facilitating audits to ensure transparency and compliance.

- Financial Compliance: Staying informed and compliant with all relevant financial laws, regulations, and the HOA's governing documents.

- Collaboration with the Board and Financial Committees: Collaborating closely with other board members and financial committees, aligning financial goals, and facilitating communication.

By delving into these responsibilities, it becomes clear that the role of an HOA Treasurer is not just financial but plays a vital role in fiscal management, transparency, collaboration, and legal compliance. Their work is the backbone of the community's financial well-being, enabling the board to make informed decisions and the community to thrive.

The Responsibilities of the HOA Treasurer

The Treasurer's responsibilities require fiscal insight, integrity, collaboration, and transparency. These responsibilities include:

Fiscal Responsibility and Oversight

Financial Reporting and Transparency

Financial Compliance

Collaboration with Others

The HOA Treasurer's role is comprehensive, demanding strong financial acumen, transparent communication, and effective collaboration. These responsibilities are central to fostering a financially stable, transparent, and compliant community. This guide will delve into these responsibilities further, providing tools, insights, and best practices to support HOA Treasurers in their vital role.

Roles and Responsibilities of an HOA Treasurer in a Self-Managed Community

In a self-managed HOA, the role of the Treasurer encompasses specific responsibilities that differentiate it from conventional HOA management. Here are the top ways the responsibilities differ:

- Direct Financial Management: In a smaller, self-managed HOA, the Treasurer is often responsible for hands-on management of all financial matters, including budgeting, accounting, and financial reporting, without the intermediary of a management company.

- Transparency and Accountability: The Treasurer's role in ensuring transparent and accurate financial records is emphasized, promoting trust and confidence within the community, such as providing regular financial updates to residents and board members and creating open channels for financial queries and concerns.

- Collaboration with Other Board Members: Working closely with the President and other board members, the Treasurer may take a more collaborative approach to financial decision-making, reflecting the community's values and goals.

- Community Financial Education: In a self-managed setting, the Treasurer may also be tasked with educating residents about the community's financial health, special assessments, or other financial matters, fostering a sense of ownership and engagement within the community.

- Tailored Financial Solutions: The Treasurer may be more involved in creating and implementing customized financial solutions that align with the specific needs and preferences of the community, ensuring a more personalized and responsive approach to financial management.

- Faster, Less Bureaucratic Decision-Making: In the streamlined structure of a self-managed HOA, the Treasurer can make financial decisions more quickly and efficiently, often in direct coordination with other board members. This agility allows for more immediate responses to financial challenges or opportunities, such as urgent repairs or investment in community amenities. The absence of a management company's bureaucratic layers speeds up financial processes, making the community more nimble and adaptable.

Challenges of the Treasurer's Role

Several common challenges and pitfalls might hinder the optimal performance of the Treasurer's duties. These challenges include:

- Strategic Planning: Creating a financial plan that aligns with community goals and budget constraints.

- Regular Communication: Maintaining an open dialogue with residents to manage expectations and explain budget decisions. Providing clear and consistent updates on financial matters, such as at board meetings. Refer to the article "How to Run an Effective HOA Board Meeting: A Step-by-Step Guide with a Free Agenda Template & Reference Sheet" for where the financial report should be included in the agenda.

- Transparent Reporting: Offering detailed and accessible financial reports to all residents.

- Confidentiality Ethics: Upholding a strong ethical commitment to confidentiality.

Navigating these challenges requires a nuanced and attentive approach that aligns with the community's needs and legal requirements. Success in these areas will contribute to the community's financial well-being, bolster trust and transparency, and uphold the integrity and efficacy of the Treasurer's role.

Challenges of Using a Property Management Company as an HOA Treasurer

Working with a property management company as an HOA Treasurer can provide significant benefits, but it also comes with many challenges:

- Loss of Control: Documents and essential information may no longer be directly in the control of the HOA, leading to potential accessibility and management issues.

- Lack of Financial Control & Limited Oversight: Outsourcing financial management might lead to reduced control over financial decisions. Additionally, the HOA may not have direct control over its financial operations. See "How One HOA Took Control of Their Community and Saved $6000 Annually."

- Unpredictable and Hidden Fees: Property management companies might charge unexpected or hidden fees, disrupting budget planning.

- Potential Conflicts of Interest: A property management company might have other clients, vendors, or interests that could conflict with the best interests of the HOA, leading to biased decisions or actions.

- Differing or Conflicting Priorities: A property management company might have different goals or business objectives that don't align with the community's best interests.

- Delayed Responses: Slower communication with a third-party entity may lead to delays in decision-making or problem resolution.

- Inconsistency in Policies and Practices: A third-party company may not be as intimately familiar with the specific bylaws and culture of the community, leading to inconsistencies in policy enforcement and practices.

- Lack of Transparency: Ambiguity in financial reporting and procedures can hinder trust and accountability.

- Lack of Technology: If the management company does not use or provide access to modern HOA management software, it will lead to inefficiencies and frustrations.

Engaging a property management company to handle the Treasurer's responsibilities can present challenges that require careful consideration and management. Understanding and developing strategies to address these potential issues can ensure the relationship is productive and aligns with the community's objectives.

Best Practices for the HOA Treasurer

Adherence to certain best practices is essential to succeed in this demanding role. These practices serve as a roadmap for fulfilling the duties of an HOA Treasurer effectively and with integrity, building a community that thrives on trust, efficiency, and inclusiveness.

Ethical Financial Leadership

• Integrity and Transparency: Uphold financial policies honestly and openly, ensuring that the community's best interests guide all financial actions and decisions.

• Compliance with Financial Laws and Regulations: Understand and adhere to all local, state, and federal financial regulations for HOAs.

Strategic Financial Planning

• Long-term Financial Vision: Develop a robust and realistic budget that aligns with the community's goals and forecast future expenses and revenues to ensure financial stability.

Regular Evaluation: Monitor progress and adjust financial strategies to ensure alignment with community objectives.

Collaborative Decision Making

• Open Communication: Encourage open dialogue with residents and board members about financial matters to foster trust and collaboration.

• Community Involvement: Facilitate community participation in financial decision-making, ensuring residents' voices are considered.

Utilizing Technology for Financial Efficiency

• Modern Tools: Implement modern accounting software to streamline financial management and leverage digital tools to enhance reporting and analysis.

• Data Security: Ensure digital tools adhere to security standards to protect sensitive information.

Financial Safeguards and Oversight with the Board

• Ongoing Oversight: Schedule periodic reviews to catch discrepancies early and maintain accuracy.

• External Auditing: Engage with external auditors to ensure full compliance with laws and regulations.

• Payment Authority: Empower the Treasurer to pay routine, recurring expenses such as utility bills and insurance premiums to streamline financial operations and ensure that essential services are uninterrupted.

• Spending Limit: To safeguard against potential abuse, the board should set a dollar limit on the Treasurer's payment authority, creating an additional layer of oversight and ensuring fiscal responsibility.

• Dual-Signature Requirement: Require two authorized signatures on all checks issued by the HOA. This additional layer of verification adds a safeguard against unauthorized or fraudulent transactions.

• Regular Reviews and Internal Controls: The board should establish internal controls and regularly review the Treasurer's activities and the association's finances. This preventive measure helps the association guard against misappropriation and embezzlement.

How reTHINK HOA Software Supports the Role of the Treasurer

The responsibilities of an HOA Treasurer are vast and integral to the community's success. Recognizing these unique demands, reTHINK HOA has crafted tailored software solutions designed specifically to enhance the role of the Treasurer. All features have been developed with built-in compliance in mind. From maximizing efficiency and collaboration to ensuring strict compliance, here's how reTHINK HOA transforms the Treasurer's responsibilities into a seamless experience.

Budgeting and Reporting Tools

Automated Assessments and Statements of Accounts

Communications and Automated Notifications

Document Sharing and Management

reTHINK HOA Software transforms the Treasurer's role by providing targeted solutions that simplify financial management. It covers all aspects of the Treasurer's responsibilities, from tailored features to streamlined processes, compliance support, and effective communication. By leveraging these tools, Treasurers can focus on strategic decision-making and community engagement, knowing that the technical and compliance aspects are in good hands. Integrating technology through reTHINK is a forward-thinking approach that resonates with the modern needs of HOA financial management.

Final Thoughts

The role of the Treasurer in a homeowners' association is paramount, not just for the smooth functioning of the community but as a beacon of trust, integrity, and stewardship. They are the guardians of the community's financial health, ensuring that every dollar is accounted for and every financial decision aligns with its goals and values.

Reflecting on the essential role of the Treasurer, it becomes clear that this position is more than just about numbers. It's about creating a transparent and accountable financial system that builds community trust and ensures sustainable growth. The Treasurer navigates the complex landscape of financial laws and regulations while balancing the budget constraints with the community's needs. They are at the helm of strategic financial planning, ethical leadership, and collaborative decision-making aimed at a prosperous community.

As with any leadership role, the path is filled with challenges, opportunities, and continuous learning. Therefore, encouragement for continuous financial improvement is vital. Whether exploring new technologies, attending educational workshops, or engaging with professional networks, every step towards improvement contributes to professional growth and community well-being.

The Treasurer's role is dynamic and ever-changing. It is an invitation to embrace the opportunities and challenges of financial leadership to build a resilient community where finances are managed with foresight, responsibility, and a clear vision for the future. In accepting this invitation, HOA Treasurers become central in shaping a community that thrives on collaboration, transparency, and mutual trust. It's a journey filled with responsibility and rewards, and it's a journey worth taking.

Footnotes & References

- California Legislative Information. Davis-Stirling §5500 Article 1. Accounting [5500-5502].

Bonus Content for Members: Treasurer's Checklist

Take advantage of our exclusive bonus content! We're providing a Treasurer's Checklist that brings all these responsibilities, best practices, and efficiency tips into one easy-to-follow guide. This indispensable resource is perfect for new and seasoned HOA Treasurers looking to improve their financial management skills and governance. Whether you're establishing your first budget or navigating through complex financial compliance, this checklist is your roadmap to success.

Sign-in or Subscribe to download your free Treasurer's Checklist and elevate your HOA financial management to the next level!

This content is only available to subscribers

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.

Sign up nowAlready have an account? Sign in